Because the cash values in a participating whole life insurance policy, deliberately engineered to rapidly build high cash values, accumulates equity (cash value) more quickly than a home mortgage, it is beneficial to pair the two together.

For example:

Jeff, a 40-year-old married man with 3 children, purchases a $300,000 home. With a 10% down payment, Jeff is able to finance the balance of the home ($270,000) with his local bank at 3.75% interest.

This leaves Jeff with a monthly mortgage payment of $1,250.41 for the next 30 years.

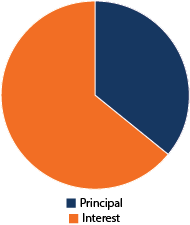

After 5 years the equity developed in Jeff’s house is equal to 36% of his total mortgage payments, plus his initial $30,000 down payment. In other words, 64% of his mortgage payments have enriched the mortgage bank instead of Jeff.

Now consider if Jeff had purchased a participating whole life insurance policy with that same $1,250.41 monthly payment over the last 5 years.

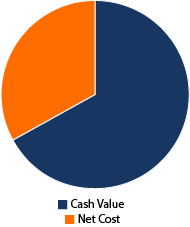

Jeff would have only paid $75,025.00 not $105,025.00 because he wouldn’t have had to make a $30,000 down payment on the life insurance policy.

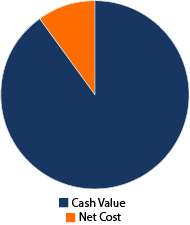

Furthermore, Jeff’s equity (cash value) in his participating whole life policy would equal 67% of his total premium payments. On top of this, because Jeff didn’t have to make a $30,000 down payment for his policy, his total cash availability now equals 107% of what his total payments have been on the participating whole life insurance policy.

But what isn’t seen in this equity comparison example is the value of the participating whole life if Jeff were to die. From the very first $1,250.41 premium payment Jeff makes, his wife and children would have received $442,686 of guaranteed death benefit, which would more than retire a mortgage of $270,000, if Jeff were to die. By year 5 however, the guaranteed death benefit would have increased to $652,227.

Thirty years down the road, Jeff’s life insurance policy guarantees a cash value (equity) of $352,414, but he will have only paid $245,447 for his policy. This is because the policy premium is reduced to only $508.75 per month after year 7. A mortgage payment meanwhile, would remain at $1,250.41 per month for the entire 30 years of Jeff’s mortgage.

Thus Jeff’s mortgage will end up costing him $450,149 after 30 years. This is $204,702 more than his participating whole life insurance policy will have cost over the same period of time.

According to the US Department of Labor and Statistics, Jeff can expect his home to be worth around $584,022 after his 30 year mortgage is retired. This equates to a 1.67% annual return on Jeff’s mortgage payments. Yet the dividends historically paid in a participating whole life insurance policy would have provided Jeff around a 3.23% rate of return by year 30.

Obviously, Jeff and his family can’t live in a participating whole life insurance policy. They need a home. But if Jeff will combine the purchase of his home with the purchase of participating whole life insurance he will have a greater financial reward.

Jeff has heard if he finances his home for 15 years instead of 30 years he will save money because he will pay less interest to the mortgage bank. In today’s world, to qualify for a 15 year mortgage Jeff will need to pay something called points in order to lock in a fixed interest rate of 4%. Thus, Jeff must come up with not only $30,000 for the down payment but also an additional $2,700 to pay for the points he needs to purchase, in order to qualify for the 15 year mortgage rate of 4% instead of having to pay a higher rate.

Using this 15 year mortgage Jeff, after 5 years, will have home equity equal to 61% of his total mortgage payments, plus his initial $30,000 down payment, instead of the 36% when he used a 30 year mortgage in the above example. This seems to prove that a 15 year mortgage will build equity and save interest over a 30 year mortgage.

But, Jeff will have had to pay $47,505 more towards his home purchase by year 5 than when he was using a 30 year mortgage to purchase his home.

Understanding this fact, Jeff realizes that a 15 year mortgage is a not a good way to keep more money due to the higher cash flow required.

Pairing a Mortgage with the Purchase of Participating Whole Life Insurance:

By utilizing the money management qualities found in each of these different approaches, Jeff can purchase his home AND participating whole life insurance at the same time. This will put Jeff in a better financial postion than if he merely chooses between a 15 or 30 year mortgage.

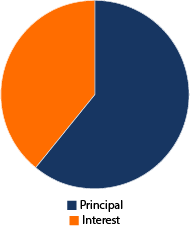

Jeff’s 15 year mortgage monthly payment would have been $1,997.16. If Jeff opts to use a 30 year mortgage to purchase his home and keeps the $746.75 difference between the $1,250.41 monthly mortgage payment and the $1997.16 monthly mortgage payment, he can use the difference, $746.75, to purchase participating whole life insurance. Let’s see what that will do for Jeff.

After his first $746.75 life insurance premium payment, Jeff will have $324,356 of guaranteed death benefit which will pay off his mortgage if he should die.

After 5 years his guaranteed equity in the policy (cash values) will be equal to 90% of his total premium payments.

By year 15 his premiums will stop. And in year 16 Jeff will have enough guaranteed cash values in his policy to payoff the remaining portion of his mortgage, if he so desires.

If Jeff choses not to pay off his mortgage in year 16 by using the cash values of his life insurance policy, the policy will continue to grow even without any further premium payments. By year 30, when his 30 year mortgage is retired, Jeff will be guaranteed to have cash values that equal $236,945, and with dividends he could have over $304,000. Of course, in addition to this money, Jeff will also own his home which will be worth around $584,022 according to the U.S. Department of Labor and Statistics.

If Jeff chooses to take a loan against his policy cash values in year 16 and pays off his mortgage, he has the option to continue paying what he was going to have to pay to the mortgage company back to the insurance company instead. In doing so, his cash values in the policy would be around $230,000 instead of $236,945 by year 30, PLUS he will still own his home worth approximately $584,022.

Of course, the participating whole life policy’s guaranteed cash values will continue to grow as long as Jeff lives, and the dividends will continue to purchase more and more death benefit for him as well. These cash values can be used for Jeff and his wife’s retirement, for helping their children with educational costs, weddings or even downpayments on their own future mortgages.

This is why combining a mortgage with the purchase of a participating whole life insurance policy is a better financial choice than merely financing a stand alone mortgage. Paying off a mortgage faster only puts more money into the hands of the mortgage bank. It does very little for the person making the mortgage payments because it keeps them from having money accumulate and grow for them.

The real key to creating wealth is to make sure the cost of spending your own money is fully understood. Once understood, keeping your money in participating whole life insurance where it can grow for you while you are allowed to leverage it will generate more wealth for you to control and manage. And that is always better than losing money to others when you finance anything, even a mortgage.