You could say that Whole Life Insurance is the godfather of life insurance because it is one of the oldest forms of life insurance, and it is still available today. People who want guaranteed growth, guaranteed protection and long-term financial peace of mind continue to buy whole life insurance.

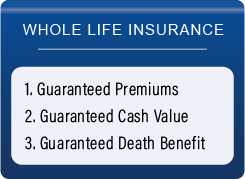

These three guarantees give the owner of a whole life policy confidence that as long as their premiums are paid:

1. The policy premium will never be higher than what is guaranteed in the policy contract.

2. The policy cash value will be equal to or exceed the cash value amount guaranteed in the policy contract.

3. The death benefit will never be lower than it was guaranteed to be in their policy contract.

Since whole life insurance was designed to last for someone’s whole life, these guarantees are lifetime guarantees.

How Does Whole Life Insurance Work?

Have you ever had a membership to a gym, a store or even a website? Life insurance is similar to having a membership because you get the benefits that are available to members only. If we are equating life insurance to a membership, whole life insurance would be the equivalent of a lifetime membership.

The most obvious benefit a life insurance company provides is death benefit. Other benefits for whole life insurance policy owners include life benefits such as cash value, benefit riders and dividends. More about cash value, benefit riders and dividends in a moment.

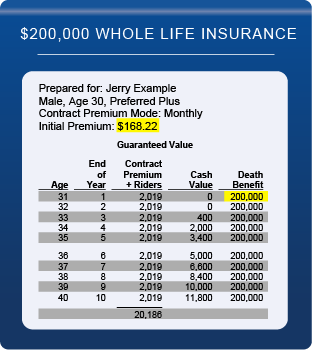

The death benefit on whole life insurance comes into existence when the first premium is paid. To paint a quick picture of how this works let’s make believe that Jerry buys a whole life insurance policy with a death benefit of $200,000 and pays the first premium of $170. The next week, on his way to work, Jerry gets hit by a drunk driver and dies. Jerry’s beneficiary will receive $200,000 even though he has only paid one premium of $170.

Life insurance policies have a death benefit that kicks in immediately, just like in the example above. The big difference between whole life insurance vs. term life insurance or universal life insurance is how long the death benefit will last. Whole life insurance guarantees that your death benefit can last forever.

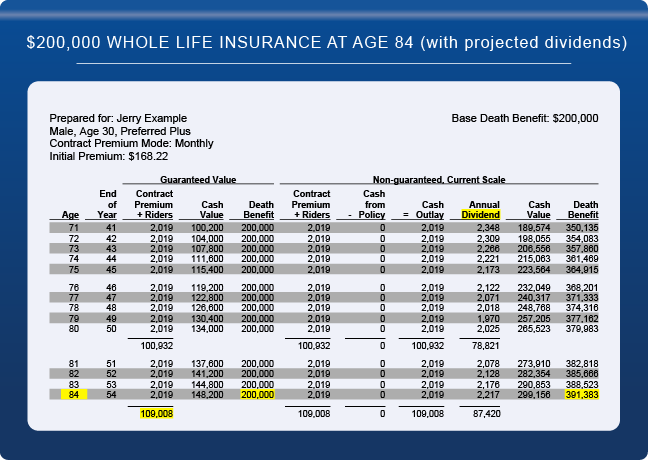

Just for example, let’s revive Jerry and let him live to be 84. Now instead of only paying $170 in premiums he’s paid more like $106,000 in premiums. When Jerry dies at age 84 his beneficiary gets his guaranteed death benefit of $200,000, plus any death benefit increases along the way which could be a total of around $390,000. Basically, Jerry’s death benefit is, at the least, almost 2x what he paid in premiums. But it may be 3x or 4x what he has paid, depending on what dividends have been paid over the years. Those are the basics of how whole life insurance works from the policy owner and beneficiary’s perspective. But how does a life insurance company make this arrangement work from their side of the contract?

The life insurance company that issues a whole life insurance policy to one person will also issue life insurance policies to other people. The life insurance company will collect the premiums on all of the policies they sell and put the money into their general fund. It is the life insurance company’s responsibility to invest that money in order to earn a return that will allow them to pay the benefits they have promised to pay. To calculate exactly how much money they need to collect in premiums and what kinds of earnings they need on their investments, the life insurance company hires people who are actuaries and use actuarial science to make those calculations.

Thanks to actuarial science, which is impressively accurate, life insurance companies are very successful at fulfilling their contracts. If you’ve been to a big city and looked up at the skyscrapers, there is a good chance that you’ve seen the name of a life insurance company on the top of one of those buildings. Not only do life insurance companies do a good job at fulfilling their promises, they also make money while doing it. That’s a good thing, especially for people who own participating whole life insurance. More on this when we get to the section about life insurance dividends.

Despite the imposing success of life insurance companies in general, it is still nice to know that life insurance companies are regulated at the state level. States require life insurance companies to keep certain amounts of money in reserve. They also require life insurance companies to have adequate re-insurance. Re-insurance is how an insurance company protects their customers from loss in the event of an unforeseen circumstance.

What Is Whole Life Insurance Cash Value?

Whole life insurance policies not only have death benefits; they also have life benefits. Most people think life insurance is for when you die, and it is, but when someone owns whole life insurance, they can use the life benefits of their policy while they’re still alive. One of the life benefits of whole life insurance is cash value.

To understand whole life insurance cash value, it is helpful to understand a home mortgage. As a homeowner makes mortgage payments, a portion of each payment goes to pay off the principal on the mortgage. This gives the homeowner equity in the home. Equity is the portion of the home that is completely paid off. When the homeowner has completely paid off the mortgage, they will have 100% equity in the home.

When someone buys whole life insurance, they are buying a death benefit, whatever that amount is, maybe $100,000 or maybe $1,000,000. In most cases, people are going to buy their death benefit with either monthly or annual premium payments. In a whole life policy that has been designed to have cash value from the beginning, every premium payment, buys base insurance and “paid-up insurance”. You can think of paid-up insurance as “paid-off insurance” because paid-up insurance is insurance that the policy owner owns completely. The equity that results from paid up insurance is called cash value in a whole life insurance policy, and it is similar to equity in a home. (Note: Not all whole life insurance policies will have cash value from the beginning. To have cash value in the beginning, the whole life insurance policy must have a paid-up insurance rider, more about this when later when we talk about whole life insurance riders.)

The owner of the policy can leverage the cash value (equity) in their whole life insurance policy much like a homeowner can leverage the equity in their home with a home equity line of credit (HELOC). It is tremendously easier to leverage whole life cash value however, than it is to leverage home equity because whole life insurance cash value can be accessed with a signature. There is no application or approval process.

To keep the comparison going, eventually a whole life policy will become paid-up completely. This is similar to when a homeowner completely pays off their home. At this point in a whole life insurance policy, the cash value amount will equal the death benefit amount. This is where my example breaks down because the homeowner will have paid all of their equity amount plus more for interest. A whole life insurance policy owner will only have paid a portion of their cash value amount in premium because the insurance company will invest the premiums the policy owner pays over the years and essentially help the policy owner pay-off their policy.

What Is Participating Whole Life Insurance?

Whole life insurance comes in two basic flavors, if you will. Participating whole life & non-participating whole life, which is often just called whole life insurance. Participating whole life insurance participates in receiving a dividend, whereas non-participating whole life insurance does not. I’ll talk about life insurance dividends next. Generally speaking, you can only buy participating whole life insurance from mutual life insurance companies. Most life insurance companies in the U.S. today are stock held life insurance companies. Stock held insurance companies are owned by stockholders who buy shares of the life insurance company’s stock off a stock exchange. A mutual life insurance company is not owned by stockholders, mutual companies do not issue public stock. Instead, a mutual life insurance company is owned by its policyholders. Anyone who owns a policy with a mutual life insurance company is a part owner of that particular life insurance company.

Life Insurance Dividends

A life insurance dividend is declared when a life insurance company has money left over after meeting all operating costs and expenses. Some of these profits will be put into reserves and the rest will be distributed as a dividend to the people who own the company. If the life insurance company is a mutual company, the dividend is paid to the people who own participating whole life insurance policies with the company. Life insurance dividends can be directed in a few different ways. There may be different options with various companies but the most common three are:

1. Take the dividend in cash

2. Use the dividend to reduce the policy premium

3. Use dividends to buy additional paid-up insurance

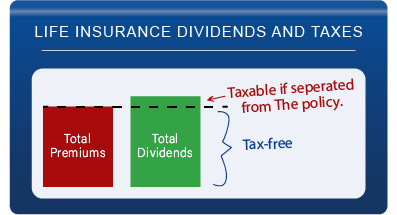

A life insurance dividend is tax-free to the owner of the policy because it is classified as return of premium and premiums are paid with after-tax dollars. Dividends will continue to be tax-free to a participating whole life insurance policy owner unless the cumulative dividends have surpassed the cumulative premiums paid for that particular policy (cumulative premiums are known as cost-basis). Once cumulative dividends exceed cost-basis, future dividends from that specific policy will become taxable if they are taken in cash or used to reduce premiums.

For a quick example let’s say that over the past 60 years Dale has paid $5,000 each year in premium for a participating whole life insurance policy. The mutual life insurance company who issued his participating whole life policy has paid a dividend to all their participating whole life insurance policy owners, including Dale, every year. For this example, let’s assume the total of all the dividends they have paid to Dale, specifically, over the past 60 years equals $300,012.

Dale’s cost-basis, which is the cumulative premiums he has paid for the policy, would be $5,000 x 60 = $300,000. Since the cumulative dividend exceeds cost-basis by twelve dollars, twelve dollars of Dale’s dividend will be taxable if he chooses to take his dividend in cash or apply it to his policy premium.

The third option is to use dividends to purchase additional paid-up insurance. This option will add death benefit to a policy and more cash value. Keeping the dividend with the policy, like this, allows the dividend to grow tax-deferred like the rest of the policy’s cash value.

Are life insurance dividends guaranteed? No, they are not. No life insurance company knows for sure how well they will do in any given year. However, several mutual insurance companies have paid a dividend to their policy owners every year, consecutively, for over 100 years.

After a dividend has been paid to a policy owner, it becomes part of the guaranteed value of their policy and the dividend cannot be reclaimed by the insurance company.

Whole Life Insurance Riders

Putting a rider on a whole life insurance policy is similar to having a side order to go with dinner. Some riders are free, and others require extra premium. Here are some of the most common whole life insurance riders along with their abbreviations:

• Paid-up Additions Rider (PUAR)

• Accelerated Benefit Rider (ABR)

• Accidental Death Benefit Rider (ADB)

• Waiver of Premium for Disability Rider (WPD)

• Child Benefit Rider (CBR)

This list may look daunting, but it’s not really that difficult to understand. I’ll break down each rider very quickly, and you will get a feel for how these riders work.

The Paid-Up Additions Rider

This rider allows a portion of a policy premium to buy paid up insurance. Paid up insurance, as you know, provides cash value. This rider is highly sought by people who want to build up cash value in whole life insurance quickly. When a person wants to build cash value in whole life insurance, it is critical to divide the premium correctly between the paid-up additions rider and the base whole life insurance policy. If too little premium is directed to the paid-up additions rider, the policy owner will not have as much cash value as they could have. If too much of the premium is directed to the paid-up additions rider, the whole life policy will become a modified endowment contract (MEC) and it will lose certain tax advantages. A life insurance agent can specify what percentage of the policy premium will be directed towards a paid-up additions rider when they are designing a whole life insurance policy. They can structure the policy correctly if they understand what they are doing.

The Accelerated Benefit Rider

This rider allows someone to have early access to a portion of their death benefit. Each life insurance company can setup their own criteria that must be met in order for this rider to be used. There are three conditions that can activate an accelerated benefit rider

1. Chronic Illness

2. Critical Illness

3. Terminal Illness

Some life insurance companies may allow their accelerated benefit rider to be activated with only terminal illness, other companies may allow activation of the rider with chronic and terminal illnesses and there are some companies which allow activation of the accelerated benefit rider under any of these three conditions.

Any insurance company who offers an accelerated benefit rider will define under which conditions the rider may be activated and how to determine if those conditions have been met. This rider, if available, can usually be added to a whole life insurance policy free of charge. If it is activated at some point, there may be a charge at that time.

The Accidental Death Benefit Rider

This rider adds an additional death benefit if the insured person was killed in an accident, granted the insured person was not taking part in a high-risk activity like sky diving, motorized racing, or other similar activities. This rider is a paid for rider meaning the policy owner will pay extra to have this rider, and they will pay in proportion to the amount of coverage that will be added by the rider.

Sometimes this rider is called an accidental death and dismemberment rider because it may also pay under severe accidents that cause dismemberment, not only in the case of death. This rider can have an age cap such as age 70. This means after the insured becomes 70 the accidental death benefit rider would no longer pay extra death benefit. Any insurance company offering this rider will define the terms and conditions of how this rider works and under what conditions it would and would not pay.

The Waiver of Premium for Disability Rider

This rider is a disability rider that sits dormant on a whole life policy unless the insured person becomes disabled. If the insured person meets the criteria defined by the insurance company for disability, the waiver of premium for disability rider kicks in and waives policy premiums. This rider is a paid for rider and usually has an age cap at age 65. Again, any insurance company offering this rider will define the terms and conditions of how this rider works and when it would come into play.

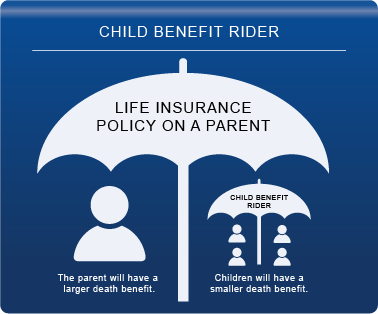

The Child Benefit Rider

This rider expands a parent’s life insurance policy to also provide a smaller death benefit on their children, until a child reaches a specified age. The Child Benefit Rider requires additional premium and it is a very economical solution for getting life insurance coverage on children. A life insurance agent can add this rider when they design a life insurance policy and specify how much death benefit coverage will be available for the child. Once this rider is underwritten, any additional children added to the family, either naturally or by adoption, can be added to the policy without additional cost.

This rider expands a parent’s life insurance policy to also provide a smaller death benefit on their children, until a child reaches a specified age. The Child Benefit Rider requires additional premium and it is a very economical solution for getting life insurance coverage on children. A life insurance agent can add this rider when they design a life insurance policy and specify how much death benefit coverage will be available for the child. Once this rider is underwritten, any additional children added to the family, either naturally or by adoption, can be added to the policy without additional cost.

There are other riders available too, these are just some of the most common riders. When someone is buying a whole life insurance policy, it is likely that they can make the policy fit their needs even better by adding one or more optional riders. When someone considers buying a whole life insurance policy with a rider it is a good practice to fully read and understand not only the policy contract, but also the terms and conditions associated with each rider being considered. Just because a rider can be added, doesn’t mean that it should be added. Riders can enhance benefits and peace of mind for the policy owner, but riders can also consume premium money unnecessarily.

How To Read a Whole Life Insurance Illustration

Being able to read and understand a whole life insurance illustration is one of the best skills someone can have when it comes to getting a good whole life insurance policy. Not all whole life insurance policies are created equal. Some are good, some are great, some are bad and some are horrid. Being able to tell the difference gives a person an advantage. There is a lot to know about reading and analyzing a whole life insurance illustration, people who are looking into buying life insurance or want to understand a policy they already have can go here and get access to the course: How to read and analyze a life insurance illustration

There are two things to do when analyzing a life insurance illustration

1. Read and understand the entire illustration

2. Analyze the guaranteed values by making comparisons between, premiums, cost-basis, cash value and death benefit

Covering these two things in adequate detail is far beyond the scope of this article, but these two things are covered thoroughly and with demonstrations in the course: How to read and analyze a life insurance illustration.

Where to Buy Whole Life Insurance

Buying life insurance is easier than ever before, but getting a good policy is probably harder than ever.

Life insurance agents are plentiful and eager to sell policies. But finding a life insurance agent who knows the how to design a policy for someone’s specific needs, by selecting the right company, using the right premium amount and adding appropriate riders, is not as easy as it could be. Additionally, it can be a struggle to find an agent who knows how to do all of this correctly and who will still answer emails and phone calls to assist their client after the policy sale. Life insurance agents make most of their money up front when they sell a policy, so unless the insurance agent has integrity or expects more business from a person, they might be unreachable after they sale a policy.

Public opinion of life insurance agents is pretty low, many people believe life insurance agents are only slightly more honest than a used car salesman. Unfortunately, this may be true.

Some people avoid life insurance agents by attempting to buy life insurance from a website. When people buy life insurance from a website, they get a fast-food grade policy. It’s life insurance, but it usually doesn’t come with long term financial benefits and lifetime personal service.

If you are interested in purchasing a Life Insurance policy make sure you’ve watched our course: How to buy Life Insurance