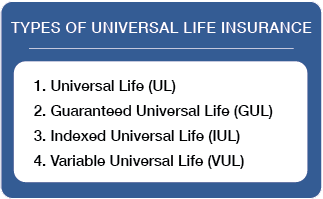

Universal life insurance is classified as a type of permanent insurance. The most common types of universal life insurance policies are:

How Does Universal Life Insurance Work?

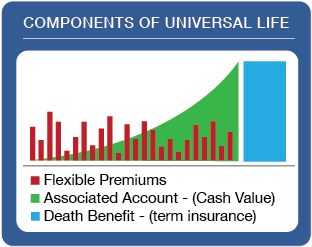

All universal life policies have an insurance component and an associated account. Unlike most permanent products, premiums on most universal life products are flexible; you can pay more, less, or skip premiums. Of course, whether you do will affect the performance of the policy.

When you pay premiums on a universal life policy, your premiums buy death benefit, pay fees associated with the policy and the remainder is deposited in the associated account as cash value. The associated account will do different things with the cash value, depending on the type of policy.

Universal Life(UL)

With plain universal life, or non-guaranteed universal life, the associated account earns an interest rate set by the insurance company. The insurance company can change this interest rate, but they typically guarantee it to fluctuate within a certain range. Money within this associated account is the cash value of the policy.

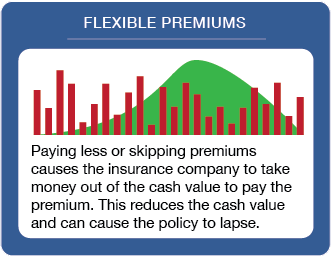

Premiums on universal life policies are flexible. If you pay less in premium or skip a premium altogether, the insurance company will supplement by withdrawing money (cash value) from the associated account. Over time this can deplete the cash value, and the policy could lapse.

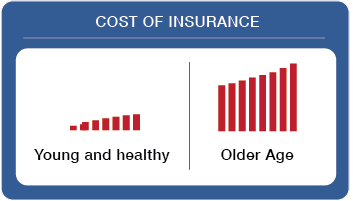

The insurance component (death benefit) of universal life policies consists of term. Term insurance is very cheap when you are young and healthy, but the cost rises sharply as you get older. Since universal life policies are based on term, their cost of insurance rises sharply as well.

Supposedly, this rising cost of insurance will be balanced out by the earnings of the cash account to withdraw cash value from the policy keeping the out-of-pocket premiums level. When the cash value runs out, policy owners have the option of paying the rising premium or letting the policy lapse. Often, the premiums are unaffordable, and the only option is to allow the policy to lapse.

Paying more than required in premium is called overfunding the policy. Overfunding a policy is often depicted as part of retirement planning strategies. The goal is to accumulate a large amount of cash value and use this money to supplement retirement income. But universal products tend to consume their own cash value to pay premium over time, so planning on this cash value for retirement income in the future is not a good idea.

Guaranteed Universal Life(GUL)

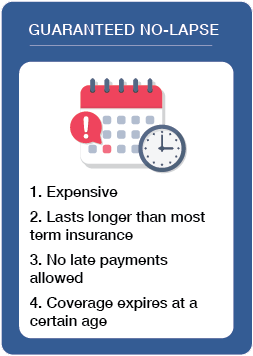

Guaranteed universal life, or guaranteed no-lapse universal life, was released to offer a solution to potential policy owners who were concerned with the lapse rate of universal policies. Guaranteed universal life policies provide a guarantee that the policy will not lapse.

Guaranteed universal life, or guaranteed no-lapse universal life, was released to offer a solution to potential policy owners who were concerned with the lapse rate of universal policies. Guaranteed universal life policies provide a guarantee that the policy will not lapse.

Guaranteed no-lapse policies require on-time payments. If you’re late on even one premium payment, you could forfeit the no-lapse guarantee.

There is usually no requirement for the insurance company to notify you when a payment arrives late. Policy owners can easily pay into the policy for years and end up with nothing to show for it because of one late payment, which they might not even realize was late at the time.

When a policy owner buys a guaranteed universal life policy, they must select an age at which the policy will end e.g., age 90, 95, 100, 121 etc. Once the policy owner reaches this age, coverage will expire.

Guaranteed universal life can be thought of as an expensive term policy which lasts longer than most term insurance.

Indexed Universal Life(IUL)

Indexed universal life insurance is one of the most popular types of universal life insurance. It differs from plain universal life in the treatment of the associated account.

The account associated with indexed universal life policies is called the cash account. Premium money left over after paying the premium and fees associated with the policy will be deposited into this cash account as cash value.

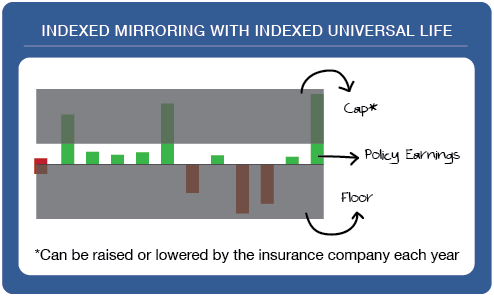

While the account of a universal policy earns an interest rate declared by the insurance company, the account of indexed universal policies mirrors an index.

While the index mirrored could be a common one, such as the S&P 500 or Nasdaq, it could also be a more specialized index such as the Hang Seng or an Emerging Market index.

Insurance companies often guarantee the return in the cash account of an indexed universal life policy to be no less than a stated percentage, usually 0.0%. This is called a floor and protects you from market downturns. The floor rate is set in the policy’s contract and is usually unchangeable.

Regrettably, indexed universal life policies also have a cap. This cap limits you from earning anything above a stated percentage. The alarming thing about a cap, is the insurance company has the right to change it, annually, to any percentage they please. This gives the insurance company a lot of control over the way indexed universal life policies perform.

The insurance component of indexed universal life insurance, like all universal products, is built on term insurance. With term insurance, the cost of insurance rises sharply as the insured grows older. Since indexed universal life insurance is based on term, the cost of insurance for indexed universal life policies rises sharply as well.

As the cost of insurance rises the insurance company supplements the premium by withdrawing money (cash value) from the cash account.

Supposedly, there will be enough money (cash value) in the cash account to continue paying for the rising cost of insurance. But this is rarely the case. The rising cost of insurance eats up cash value very quickly.

Once the cash value is gone, the policy owner can choose to either pay the entire premium or let the policy lapse. At this point, there will be no money (cash value) left in the policy and hence, no surrender value.

Like universal life policies, premiums on indexed universal life policies are flexible. As you pay less or skip premiums, the insurance company supplements with money (cash value) from your cash account.

When you pay more in premiums, overfund the policy, more money is deposited into your cash account. While overfunding is a commonly illustrated strategy, especially in retirement planning, it rarely makes sense. The strategy may keep the policy from lapsing for a few years down the road, but over time indexed universal life policies usually consume all accumulated cash value.

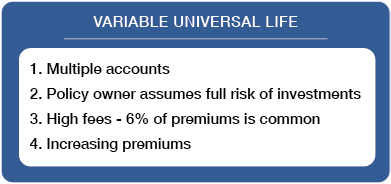

Variable Universal Life(VUL)

Variable universal life policies are very similar to plain and indexed universal life policies. The difference is in the treatment of the associated account.

Variable universal life (VUL) actually has many sub, or separate, accounts. The money (cash value) within these accounts is invested directly in securities such as stocks, bonds, mutual funds, etc., as opposed to indexed policies which mirror an index.

As a VUL policy owner, you are the one to decide in which sub you wish to invest your cash value, and you are in charge of monitoring these accounts.

Unlike indexed policies, you assume full risk for these investments. It’s worth noting your cash value and death benefit, depend on how well your investments preform.

Because variable universal life policies allow you to invest in securities, agents who sell these products must hold both an insurance and a securities license.

A big drawback to variable universal life products is the fees. Fees add up quickly on VUL policies; it isn’t uncommon for fees to be as much as 6% of your premium payment.

VUL policies are built on term as well, so the cost of insurance rises sharply as you get older. If there isn’t enough equity (cash value) to pay for the increasing cost, the policy owner must foot the rising premium themselves. If they can’t keep up with the rising premium, the policy will lapse.

Conclusion

So, why would anyone own universal life insurance? We’ve wondered that a lot, and we’ve found there are usually two reasons people purchase universal life products.

- They were “starry eyed”. Many people get carried away with the investment potential of universal products and forget, or disregard, the risks associated with it.

- Their agent “sold” it to them. A lot of people don’t really look at the policy before they buy it, they just trust their agent to pick a good product and set it up right. It’s up to you if you want to do that, but remember, you’re the one paying for it, not your agent.