All types of life insurance available today fall into one of two categories: Temporary or Permanent.

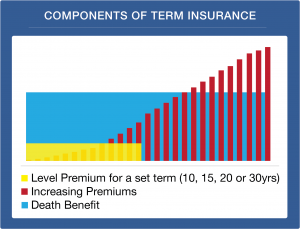

Term insurance falls into the temporary category because it provides insurance coverage for a specific number of years, or term of years, usually 10,15, 20 or 30. After the term is over the premium needed to keep the insurance in place gets ridiculously high. Due to the significant increase in premium after the level term period has ended most people let their term policies lapse rather than continuing the premiums at ever increasing rates. This is the reason why more than 90% of term policies never pay a death benefit.

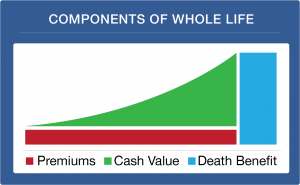

Whole Life insurance is in the permanent insurance category. Whole life insurance can be thought of as the “slow and steady”. It is based on solid guarantees and contractual promises.

In addition to having a death benefit that is guaranteed for your entire life, whole life insurance also has a guaranteed cash value that grows throughout the life of the policy. This cash value can be accessed through a policy loan or withdrawal at any time, for anything.

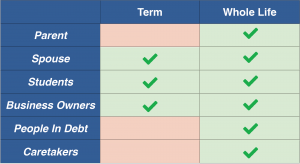

Now let’s do a comparison between Term and Whole life insurance. We’ll look at a few different scenarios and determine whether Term insurance or Whole Life insurance would be the better buy in these situations:

Now let’s do a comparison between Term and Whole life insurance. We’ll look at a few different scenarios and determine whether Term insurance or Whole Life insurance would be the better buy in these situations:

Before going further, we must realize that there is no “one size fits all”. The following comparisons are generalizations. The kind of life insurance you’ll need will depend on your financial goals, the state of your current finances, your debt situation, how many dependents you have, your health and your age.

For most people a healthy combination of term and whole life insurance is in order because this allows you to get the relatively high death benefit to cheap premium ratio provided by the term insurance and the solid guarantees of the whole life insurance (including that cash value buildup and the opportunity to earn dividends)

If you’re a parent: life insurance can help pay for your children’s expenses. This would be a case for Whole life insurance because it accumulates a cash value which can be used during your lifetime. Think: tuition, college, weddings, new cars, house down payments, business ventures and more. There is no list of ‘approved uses’ the cash value of whole life insurance policies can be used for anything

As a spouse: life insurance can help supplement income for your partner. If you’re the sole income earner, then a life insurance policy can provide income replacement for your spouse should something happen to you. For stay-at-home moms, insurance on your life would help your partner with childcare and raising of the children should something happen to you.

This is a great place for Term insurance. Term insurance has a low cost and a specific time period. If we have certain time period obligations to fulfill like raising children, then making sure the level Term period will be active until the youngest child is grown would be important. If we’re providing for a spouse, that’s a lifetime commitment and Whole Life insurance would be needed to fulfill that commitment.

Students: With life insurance you can keep your student loans from being passed on to your loved ones. Federal student loans are forgiven if a borrower dies, but private student loans are transferred on to the loan’s co-signers. This means your co-signers would be responsible for paying off the rest of your debt. But with life insurance you can use either the cash value to pay off the loans, if sufficient, or the death benefit) can be used to pay off the debt.

Students: With life insurance you can keep your student loans from being passed on to your loved ones. Federal student loans are forgiven if a borrower dies, but private student loans are transferred on to the loan’s co-signers. This means your co-signers would be responsible for paying off the rest of your debt. But with life insurance you can use either the cash value to pay off the loans, if sufficient, or the death benefit) can be used to pay off the debt.

Term insurance is most definitely in order here. Most students don’t have the income (right at first) to support a whole life policy that would pay off all their debt, but prices for Term insurance start out very low and most everyone can afford Term insurance. As time goes by and income increases, Whole Life insurance would be in order to provide the cash value buildup and the lifetime protection needed.

Business Owners: Life insurance can help your business stay running after you’re gone. A business can be named as the beneficiary of a life insurance policy. This means an allocated portion of your death benefit can be used to fund the business, buy out other business partners, shares and more. Term insurance is certainly a candidate here, but Whole Life insurance is also necessary. While a business is young and/or the business partners are young, Term insurance seems the easier way to go…premiums are low and benefits are high, but as the business grows and the partners get older, Term insurance will get too expensive. This is where a healthy mix of both types of policies are in order. Starting Term and Whole Life policies while the partners are young will lock in great rates and maximize coverage while keeping the initial outlays low. Over the years as the business generates higher income the Term insurance can be converted into Whole Life insurance to keep the coverage in place.

Life insurance also helps People in Debt: similar to student loans, not all loans are forgiven when you die. Things like mortgages, car payments and credit card debts for example can be passed on to a spouse or whoever shares them with you. Life insurance payouts can help pay off these debts. But who says you have to wait until you die to pay off debt? Whole Life Insurance allows you to use the cash value during your lifetime to manage these debts.

Caretaking: Most of us have a parent, grandparent or sibling that we are taking care of or will be taking care of. Life insurance, specifically whole life insurance, can enable you to get help for the person you’re caring for. Unlike long term care insurance that specifies what qualifications the caretaker must have, and the minimum hours needed to qualify for the benefit, cash value of Whole Life insurance policies can be accessed for anything…including caregiving. By using cash value from your Whole Life insurance, you can secure the services of the person who will be able to best care for your loved one without having to meet long term care qualifications.

Throughout these scenarios we’ve seen how a combination of both Term and Whole Life insurance can be utilized to give the maximum protection and best benefits. Everybody’s personal situation is unique so it is important to have life insurance solutions that can be customized to your own lifestyle, needs, comfort and affordability.

If you are looking to buy life insurance, this course gives you what you need to know to buy a good policy: How to buy Cash Value Life Insurance