Risk

An often-overlooked fact about universal life insurance policies, is risk.

With most insurance products, the insurance company assumes the risk. Not so with universal life policies! Due to the way the universal life contract is structured, the risk transfers away from the insurance company, directly onto the policy owner.

This is true for all types of universal policies, whether it is plain universal life (UL), indexed universal life (IUL) or variable universal life (VUL). (Find out how universal life policies work here).

Prone to Lapse

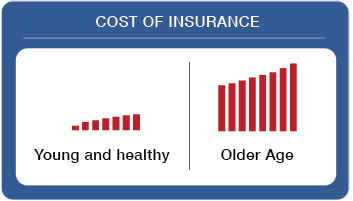

Unfortunately, because of the way universal life policies are structured, they have a natural tendency to lapse. This usually occurs between the insured’s age 60 – 80. Universal Life insurance is built on a Term insurance foundation.

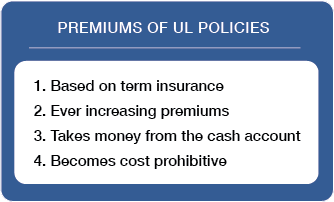

As the term insurance becomes more expensive year by year, money in the cash account is used to cover the rising cost of insurance. Then, typically between ages 60-80, the insurance gets so expensive it uses up the entire value of the cash account. To continue paying premiums after this point becomes cost prohibitive, to most, as the policy is essentially a one-year renewable term policy… very expensive with ever-increasing premiums. With no incoming premiums, and no way to pay for the insurance out of the cash account, the policy lapses.

Taxes

Because of the way taxes are deferred on the growth in life insurance policies, if a policy lapses, the policyowner could find themselves in a tax situation. Depending on the way the policy has been managed, this could be a really big tax situation.

Use of Term Insurance

Universal life insurance is built on term insurance. Term life insurance is designed as a temporary insurance, lasting a set number (term) of years.

Term was never designed to be used as a permanent product. When used as a permanent product, term is the most expensive insurance you can buy.

Because universal policies are built on term, universal polices tend to be very expensive.

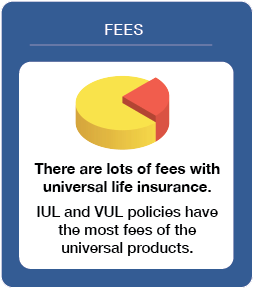

Fees

It is typical of all insurance products to have a fee. Universal life products have a lot of them. Indexed universal life insurance and variable universal life insurance policies have the most fees of all universal products.

In fact, it’s not uncommon for the fees on variable universal life policies to be as much as 6% of total premium payments.

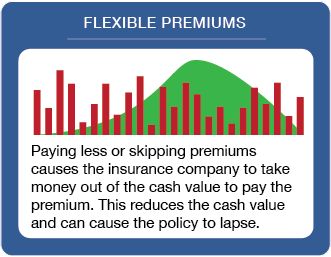

Flexible Premiums

Many universal policies offer “flexible premiums”. This allows the owner to pay varying amounts in premium, or even skip premiums. But the way the premiums are paid, in full, in part or skipped completely, has a big impact on the policy’s cash value. If enough is paid in premium to cover the rising cost of the term base, which universal life is built on, everything should be okay. But if there is not enough paid in premium to cover the cost of the term base, the difference will be withdrawn from the cash value. If there is not enough cash value to cover, the policy will lapse (more about this here).

Many universal policies offer “flexible premiums”. This allows the owner to pay varying amounts in premium, or even skip premiums. But the way the premiums are paid, in full, in part or skipped completely, has a big impact on the policy’s cash value. If enough is paid in premium to cover the rising cost of the term base, which universal life is built on, everything should be okay. But if there is not enough paid in premium to cover the cost of the term base, the difference will be withdrawn from the cash value. If there is not enough cash value to cover, the policy will lapse (more about this here).

There are different types of universal life policies, plain, indexed, variable, etc. Each one works slightly differently, but they are all very similar. You can learn more about the types of universal life insurance and how they work here.